Are you looking for an easy way to calculate your taxes at a 9.75% rate? Look no further! We’ve got a printable tax chart that will make this process a breeze. Whether you’re a business owner or an individual, this tool is sure to come in handy.

With tax season right around the corner, having a clear understanding of your tax responsibilities is crucial. Our printable tax chart for 9.75% will help you quickly determine how much you owe based on your income. No more guesswork or complicated calculations!

Printable Tax Chart For 9.75%

Printable Tax Chart For 9.75%

Using our printable tax chart is simple. Just locate your income bracket and corresponding tax rate to find out how much you need to set aside for taxes. This handy tool takes the stress out of tax season, allowing you to focus on what matters most.

Whether you’re a freelancer, small business owner, or employee, knowing how much you owe in taxes is essential for proper financial planning. Our printable tax chart for 9.75% will give you the clarity you need to budget effectively and avoid any surprises when tax time rolls around.

Don’t let tax season overwhelm you. Take control of your finances with our printable tax chart for 9.75%. By having a clear understanding of your tax obligations, you can make informed decisions and stay on top of your financial goals. Say goodbye to tax-related stress and hello to financial empowerment!

In conclusion, our printable tax chart for 9.75% is a valuable tool for anyone looking to streamline their tax calculations. With this handy resource, you can easily determine how much you owe and plan your finances accordingly. Take the guesswork out of tax season and start using our printable tax chart today!

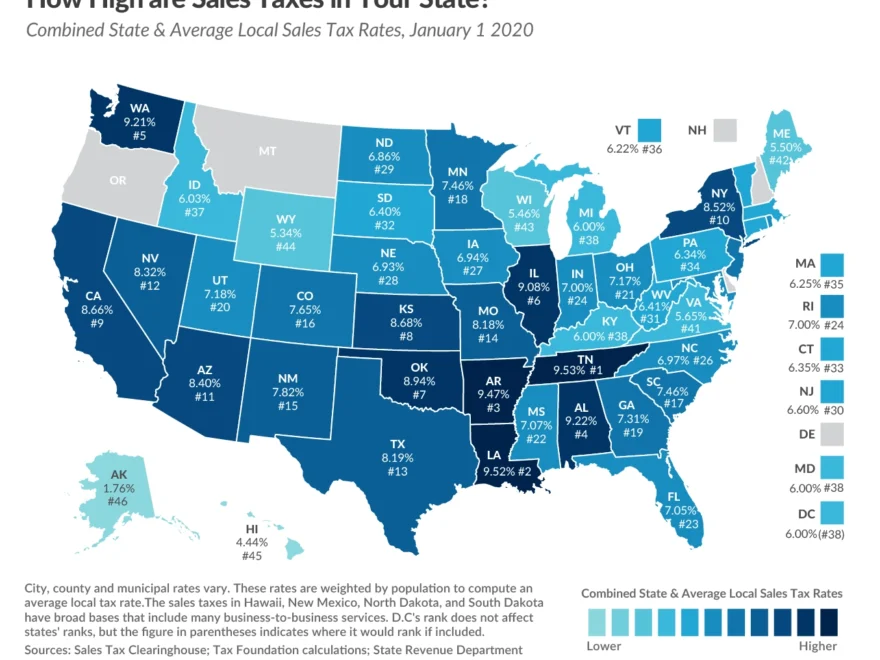

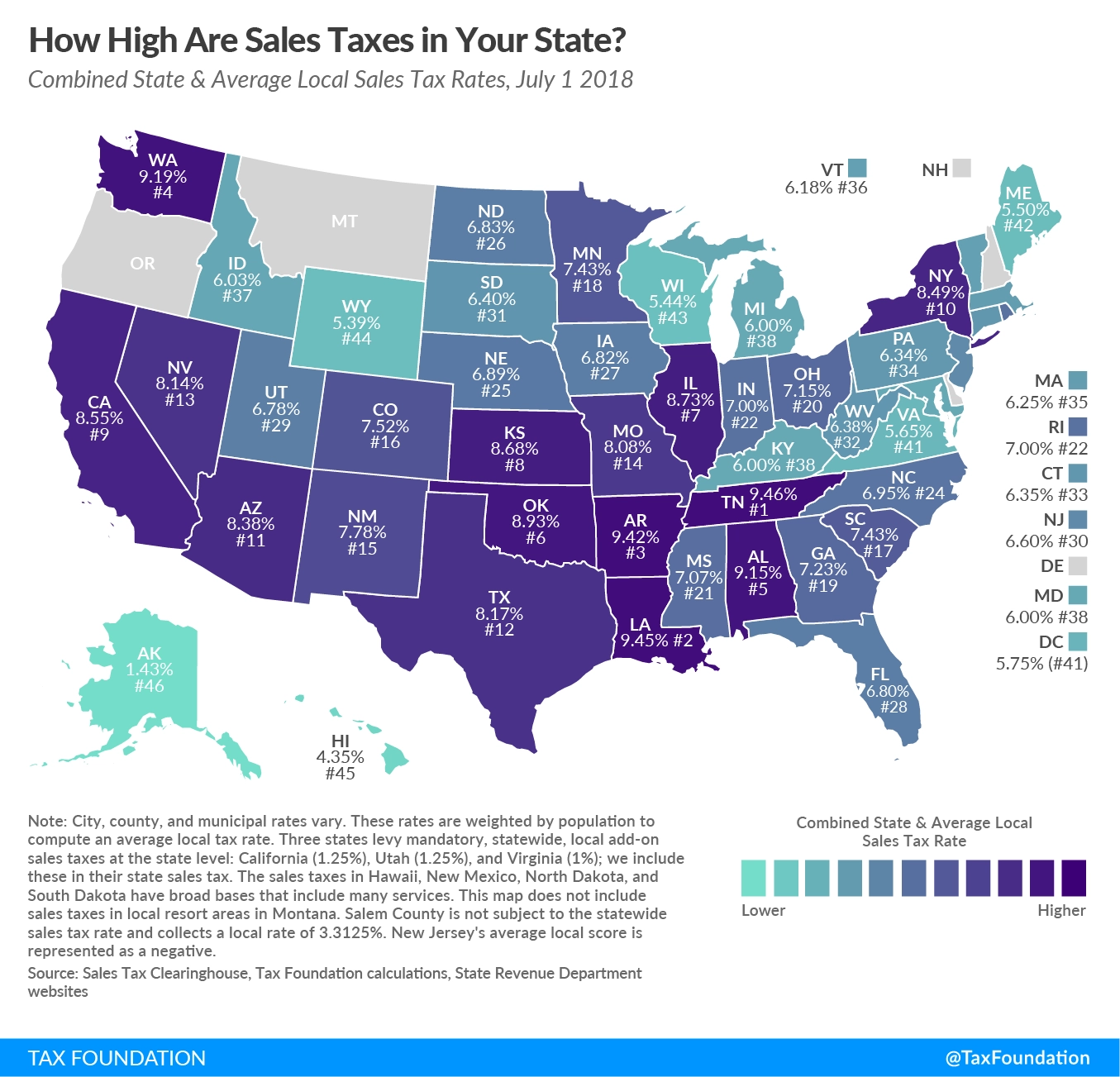

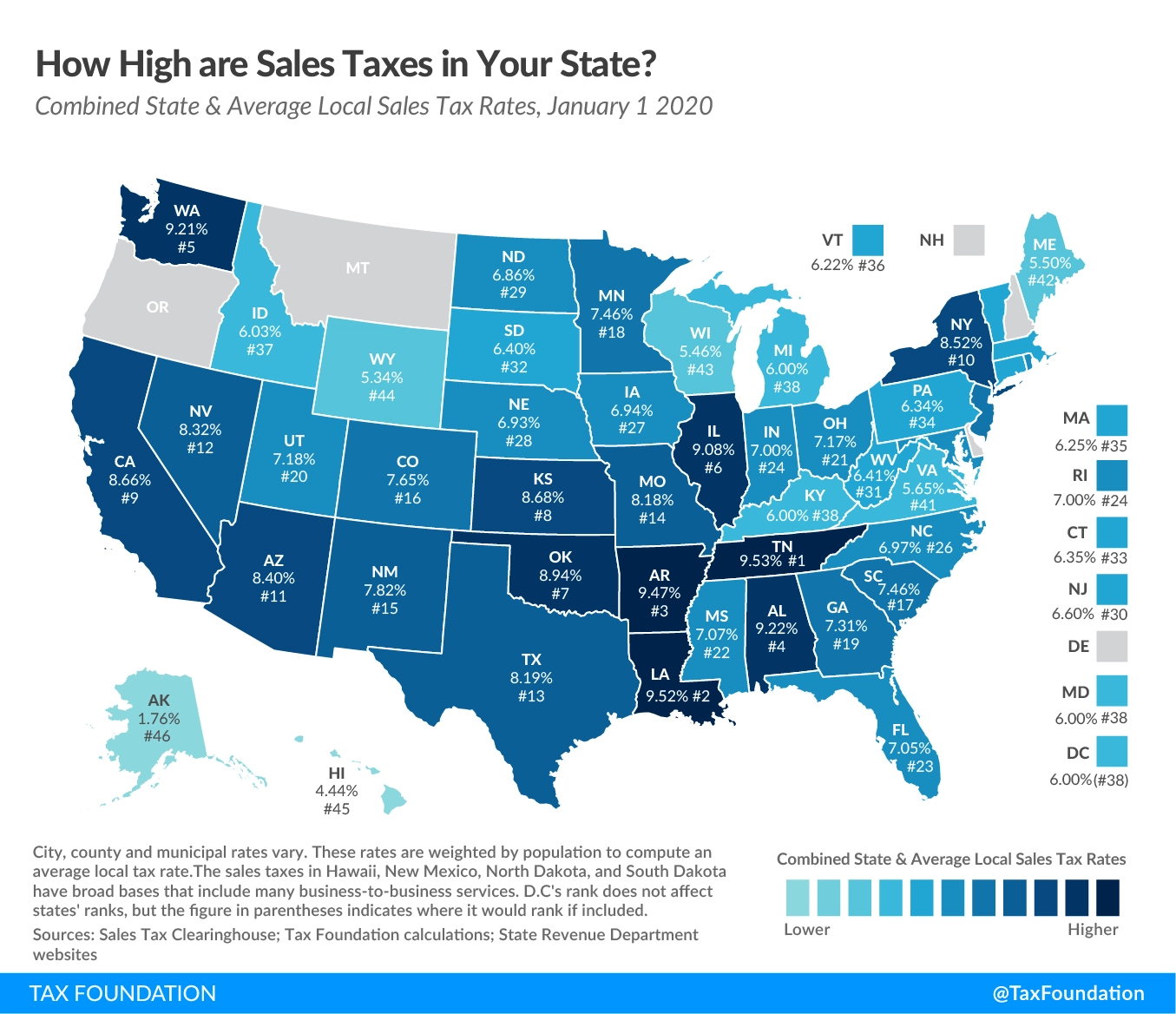

2025 Sales Tax Rates Sales Taxes By State

2025 Sales Tax Rates Sales Taxes By State